Comprehensive general liability insurance for small business – Comprehensive general liability insurance (CGL) serves as a cornerstone of protection for small businesses, safeguarding them against a wide range of potential risks and liabilities. This insurance policy provides a financial cushion, ensuring peace of mind and enabling businesses to thrive in the face of unforeseen circumstances.

CGL insurance shields small businesses from financial losses arising from claims of bodily injury, property damage, and personal and advertising injuries. It covers legal expenses, settlements, and judgments, offering a comprehensive safety net against costly lawsuits.

Comprehensive General Liability Insurance

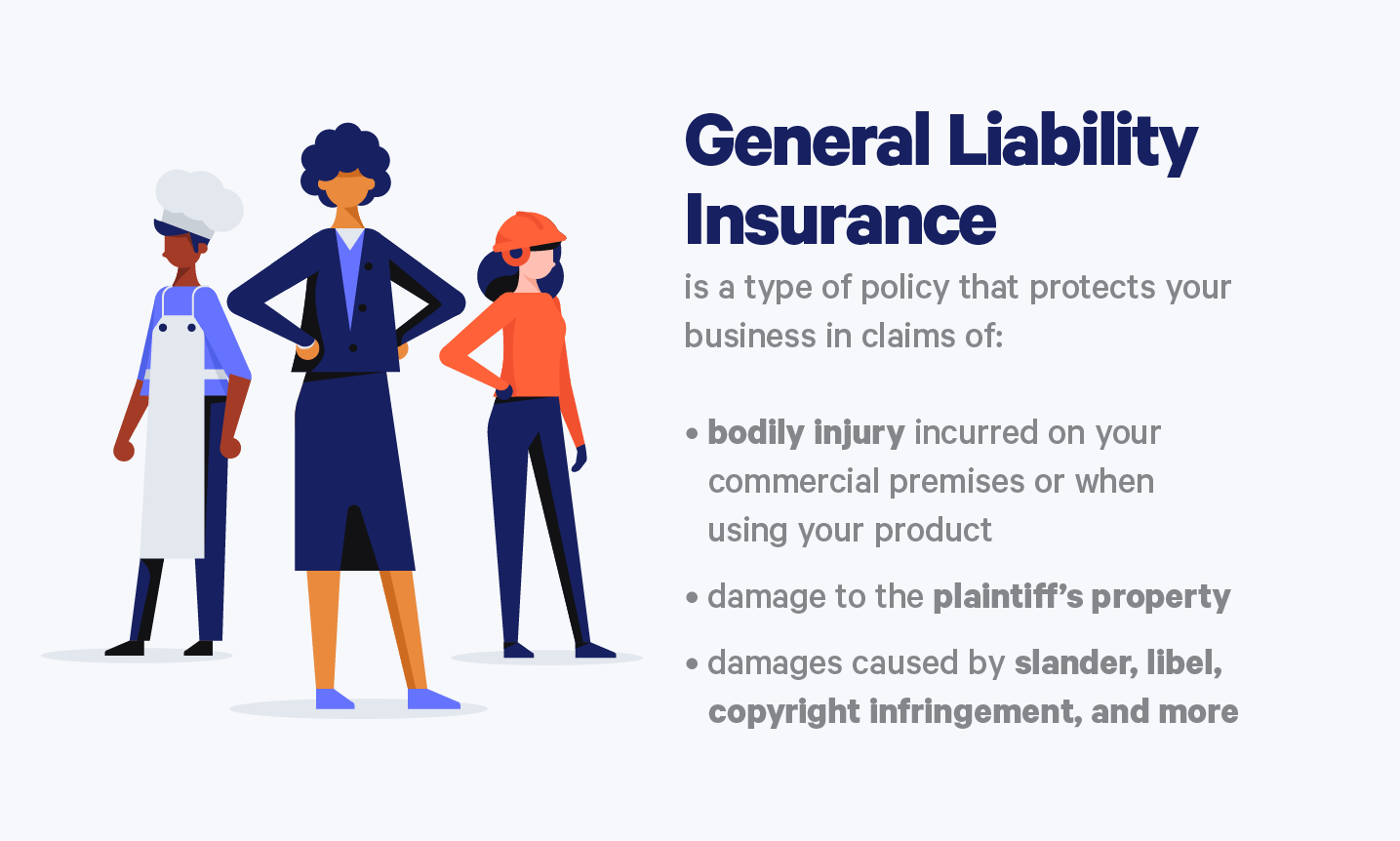

Comprehensive general liability (CGL) insurance is a type of business insurance that protects small businesses from financial losses resulting from third-party claims of bodily injury, property damage, or personal injury, such as libel, slander, or false advertising. It is a crucial component of a comprehensive risk management strategy, providing coverage for a wide range of liabilities and risks.

Coverage Scope

CGL policies typically cover the following:

- Bodily injury or property damage caused by the business, its products, or its operations

- Personal injury, such as libel, slander, or false advertising

- Medical expenses for injuries sustained on the business premises

- Legal defense costs associated with covered claims

Types of Risks and Liabilities Covered

CGL insurance covers various types of risks and liabilities, including:

- Premises liability:Claims arising from injuries or damages occurring on the business premises

- Product liability:Claims related to injuries or damages caused by defective products

- Operations liability:Claims resulting from the business’s operations, such as accidents involving company vehicles

- Completed operations liability:Claims arising from injuries or damages caused by products or services provided after the project’s completion

Benefits of CGL Insurance for Small Businesses

Comprehensive General Liability (CGL) insurance is a crucial safeguard for small businesses, providing protection against a wide range of financial risks. By mitigating potential liabilities, CGL insurance empowers small businesses to operate with greater confidence and financial stability.

Protection against Financial Losses

- Coverage for Lawsuits:CGL insurance covers legal expenses and damages awarded in lawsuits arising from bodily injury, property damage, or other liabilities.

- Compensation for Victims:It provides compensation to victims who suffer injuries or property damage due to the negligence of the insured business.

- Defense Costs:CGL insurance covers the costs of defending against lawsuits, including attorney fees, court costs, and investigation expenses.

Peace of Mind and Security

Beyond financial protection, CGL insurance offers peace of mind and security to small business owners. Knowing that their business is protected against unforeseen events allows them to focus on growth and innovation without the constant worry of potential liabilities.

Key Considerations When Purchasing CGL Insurance: Comprehensive General Liability Insurance For Small Business

When selecting a CGL policy, it’s crucial to consider several key factors to ensure the policy meets your business’s specific needs and provides adequate protection.

Policy Limits and Exclusions

Understanding policy limits is essential. These limits determine the maximum amount of coverage provided by the policy. It’s important to select limits that are sufficient to cover potential claims against your business. Additionally, it’s crucial to review policy exclusions, which specify situations or events that are not covered by the policy.

By understanding these exclusions, you can make informed decisions about additional coverage options.

Deductibles and Premiums

Deductibles are the amount you pay out-of-pocket before the insurance policy begins to cover claims. Choosing a higher deductible can lower your insurance premiums, but it also increases your financial responsibility in the event of a claim. It’s important to strike a balance between affordability and adequate coverage when selecting a deductible.

Premiums, the cost of insurance coverage, are influenced by factors such as the policy limits, deductibles, and the risk profile of your business.

Coverage Exclusions and Limitations

CGL insurance policies have specific exclusions that limit the coverage they provide. Understanding these exclusions is crucial to ensure your business is adequately protected.

Common Exclusions

Common exclusions in CGL policies include:

- Intentional Acts:Damage or injury caused intentionally by the policyholder or their employees is not covered.

- Criminal Acts:Illegal activities, such as theft or fraud, are not covered.

- Pollution:Damage caused by pollution is typically excluded, unless specifically covered by an endorsement.

- Products Liability:Claims related to defective products are generally excluded, as they are covered by separate product liability insurance.

- Workers’ Compensation:Injuries to employees are covered by workers’ compensation insurance, not CGL insurance.

Reasons for Exclusions, Comprehensive general liability insurance for small business

These exclusions exist for several reasons:

- To prevent coverage for intentional or illegal acts that would encourage misconduct.

- To limit coverage for risks that are more appropriately handled by specialized insurance policies, such as product liability or pollution insurance.

- To avoid duplicate coverage with other insurance policies, such as workers’ compensation insurance.

Situations Not Covered

Examples of situations not covered by CGL insurance include:

- A business owner intentionally sets fire to their property to collect insurance money.

- An employee steals money from a customer, which is not covered under CGL’s crime coverage.

- A company releases toxic chemicals into the environment, which is excluded unless covered by a pollution endorsement.

- A customer suffers an injury from a defective product, which is not covered by CGL but by product liability insurance.

- An employee is injured on the job, which is covered by workers’ compensation insurance.

Additional Coverages and Endorsements

Comprehensive General Liability (CGL) insurance policies provide a solid foundation of coverage for small businesses. However, additional coverages and endorsements can enhance protection and tailor policies to specific business needs.

Optional coverages extend the scope of the policy, while endorsements modify existing coverages or add new ones. These enhancements ensure that businesses have the necessary protection for their unique operations.

Optional Coverages

Optional coverages enhance the standard CGL policy by providing additional protection in specific areas:

- Commercial Auto Coverage:Extends liability coverage to vehicles used for business purposes.

- Cyber Liability Coverage:Protects against data breaches, cyberattacks, and other technology-related incidents.

- Professional Liability Coverage:Provides coverage for errors and omissions in the performance of professional services.

- Product Liability Coverage:Protects businesses from claims arising from defective products they manufacture or sell.

Endorsements

Endorsements are riders attached to CGL policies that modify or expand coverage. Common endorsements include:

- Additional Insured Endorsement:Extends coverage to entities or individuals who are not named on the policy but have a contractual relationship with the insured.

- Blanket Additional Insured Endorsement:Provides coverage to all additional insureds, regardless of their identity or contractual relationship.

- Waiver of Subrogation Endorsement:Prevents the insurance company from seeking reimbursement from third parties who are also liable for damages.

Claim Handling Process

Understanding the steps involved in filing a CGL insurance claim is crucial for small businesses to protect their interests effectively. This section provides a detailed overview of the claim handling process, highlighting the documentation required and emphasizing the significance of timely claim reporting.

Steps Involved in Filing a CGL Insurance Claim

- Notify the insurance company promptly:Report the incident or occurrence that could potentially lead to a claim as soon as possible. Timely reporting allows the insurer to initiate the investigation process promptly, preserving evidence and preventing further losses.

- Provide detailed information:Submit a written notice of claim to the insurance company, including the policy number, a description of the incident, and contact information for all involved parties.

- Gather necessary documentation:Collect and organize relevant documentation to support the claim, such as contracts, invoices, witness statements, medical records, and photographs of the damage.

- Cooperate with the adjuster:The insurance company will assign an adjuster to investigate the claim. Provide the adjuster with access to the premises, documents, and any other information they request.

- Negotiate a settlement:Once the adjuster has assessed the damages, they will negotiate a settlement amount with the policyholder. This amount should fairly compensate for the covered losses.

Importance of Timely Claim Reporting

Promptly reporting a potential claim is essential for several reasons:

- Preserves evidence:Delaying reporting can result in the loss or deterioration of evidence, making it more challenging to establish the validity of the claim.

- Limits liability:Failure to report a claim within the specified time frame could lead to the denial of coverage or a reduction in the settlement amount.

- Protects the policyholder’s rights:Reporting a claim promptly ensures that the policyholder’s rights under the insurance policy are protected.

Risk Management Strategies to Reduce Liability

Small businesses face various potential liabilities that can impact their financial stability and reputation. Implementing effective risk management strategies is crucial to minimize these risks and protect the business.

Risk management involves identifying, assessing, and mitigating potential hazards. By taking proactive measures, businesses can reduce their liability exposure and create a safer operating environment.

Best Practices for Risk Mitigation

- Regular Risk Assessments:Regularly review business operations to identify potential hazards and vulnerabilities.

- Employee Training:Provide comprehensive training to employees on safety protocols, legal compliance, and risk awareness.

- Safe Work Environment:Maintain a safe and hazard-free workplace by addressing potential risks, such as slips, falls, and equipment malfunctions.

- Vendor and Contractor Management:Carefully select and monitor vendors and contractors to ensure they meet safety and quality standards.

- Insurance Coverage:Obtain adequate comprehensive general liability insurance to provide financial protection against potential claims.

Role of Insurance in Risk Management

Insurance plays a vital role in a comprehensive risk management plan. While it does not eliminate all risks, it provides a financial safety net to cover unexpected events that may result in legal liability.

By understanding their liability exposure and implementing proactive risk management strategies, small businesses can minimize their risks, protect their assets, and create a more stable operating environment.

Comparison of CGL Insurance Providers

When selecting a CGL insurance provider for your small business, it’s crucial to compare different options to find the best fit for your coverage needs and budget. Here are some key factors to consider:

- Coverage Options:Review the specific coverage provided by each insurer, including limits of liability, deductibles, and coverage exclusions.

- Premiums:Compare the premiums charged by different providers to ensure you’re getting the best value for your coverage.

- Customer Service:Consider the reputation and responsiveness of each insurer’s customer service team, as you may need to rely on them in the event of a claim.

Provider Comparison Table

To help you make an informed decision, here’s a comparison table of some leading CGL insurance providers:

| Provider | Coverage Options | Premiums | Customer Service |

|---|---|---|---|

| Provider A | Comprehensive coverage options with high limits | Competitive premiums | Excellent customer service with quick response times |

| Provider B | Standard coverage options with customizable endorsements | Affordable premiums for small businesses | Good customer service with helpful and knowledgeable agents |

| Provider C | Flexible coverage options with tailored solutions | Slightly higher premiums | Exceptional customer service with dedicated account managers |

Selecting the Best Provider

To select the best CGL insurance provider for your small business, consider the following tips:

- Assess your coverage needs:Determine the specific risks your business faces and the level of coverage you require.

- Compare quotes from multiple providers:Get quotes from several insurers to compare coverage options and premiums.

- Read reviews and testimonials:Check online reviews and testimonials to gauge the experiences of other businesses with different providers.

- Consider your budget:Ensure the premiums you’re paying are affordable for your business while still providing adequate coverage.

Real-Life Case Studies

Comprehending the true value of CGL insurance can be enhanced by examining real-life instances where it has proven its worth for small businesses.

CGL insurance has acted as a financial safeguard for countless small businesses, shielding them from substantial losses and safeguarding their operations.

Case Study: A Local Restaurant

A local restaurant faced a lawsuit alleging food poisoning from a customer who consumed a dish prepared in their kitchen. The restaurant’s CGL insurance covered the legal expenses, including attorney fees and court costs, as well as the settlement awarded to the customer.

Without this coverage, the restaurant could have faced financial ruin.

Final Summary

In conclusion, comprehensive general liability insurance is an indispensable investment for small businesses. It provides a comprehensive layer of protection against financial risks, ensuring business continuity and growth. By understanding the coverage, exclusions, and risk management strategies associated with CGL insurance, small businesses can tailor their policies to meet their specific needs and operate with confidence.

Detailed FAQs

What are the key benefits of CGL insurance for small businesses?

CGL insurance provides numerous benefits, including financial protection against lawsuits, coverage for legal expenses, and peace of mind in knowing that the business is protected.

What types of risks are covered under CGL insurance?

CGL insurance covers a wide range of risks, including bodily injury, property damage, personal and advertising injuries, and legal expenses.

What are the common exclusions under CGL policies?

Common exclusions include intentional acts, criminal activities, and contractual liabilities.