AARP secondary insurance to Medicare offers an array of supplemental coverage options, providing individuals with the opportunity to fill gaps in their Medicare coverage and gain access to additional benefits. With eligibility requirements and enrollment processes varying based on individual circumstances, it’s crucial to explore the costs, premiums, and customer service aspects to make informed decisions.

By comparing AARP Medicare supplemental insurance to other options, individuals can determine the best fit for their healthcare needs.

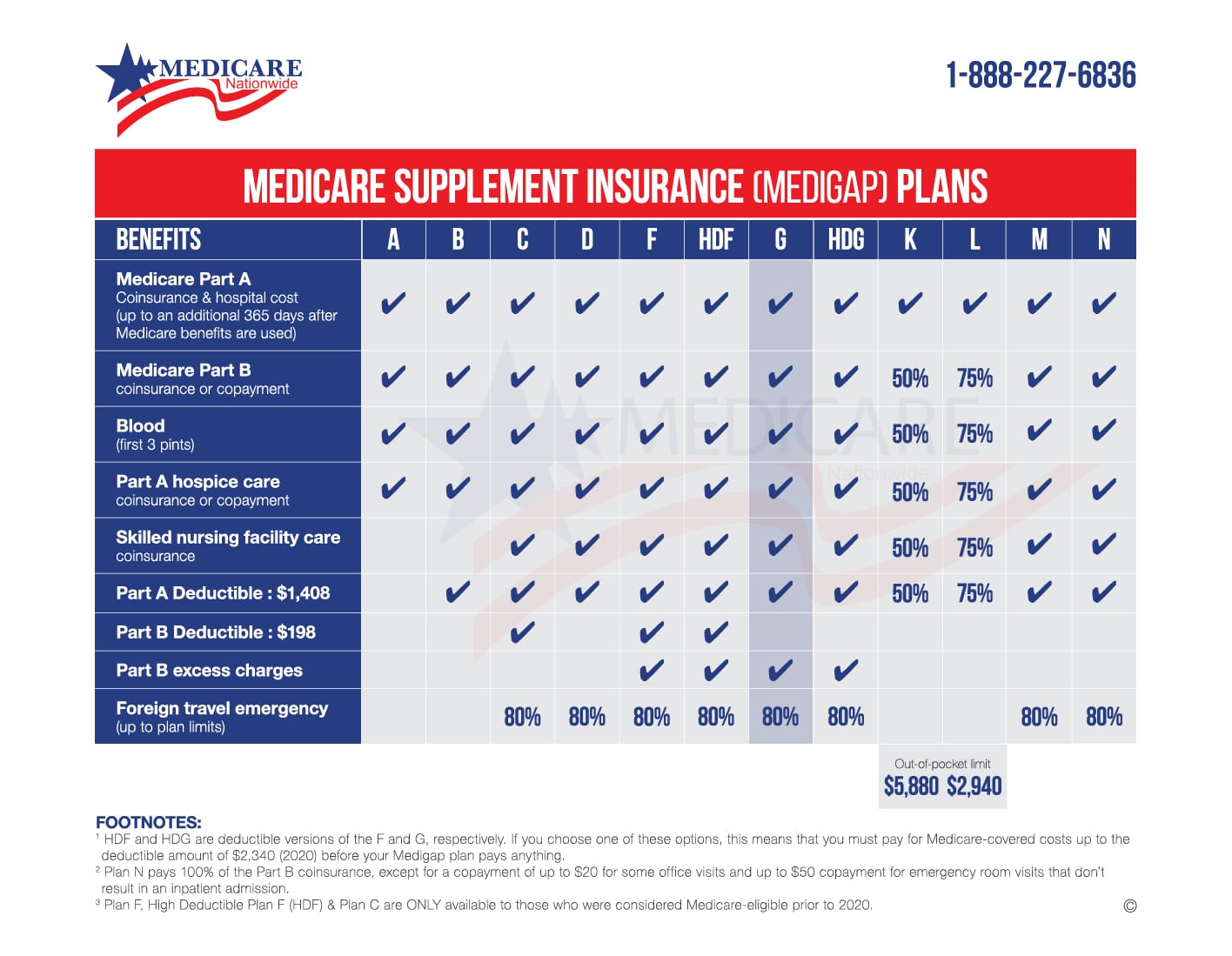

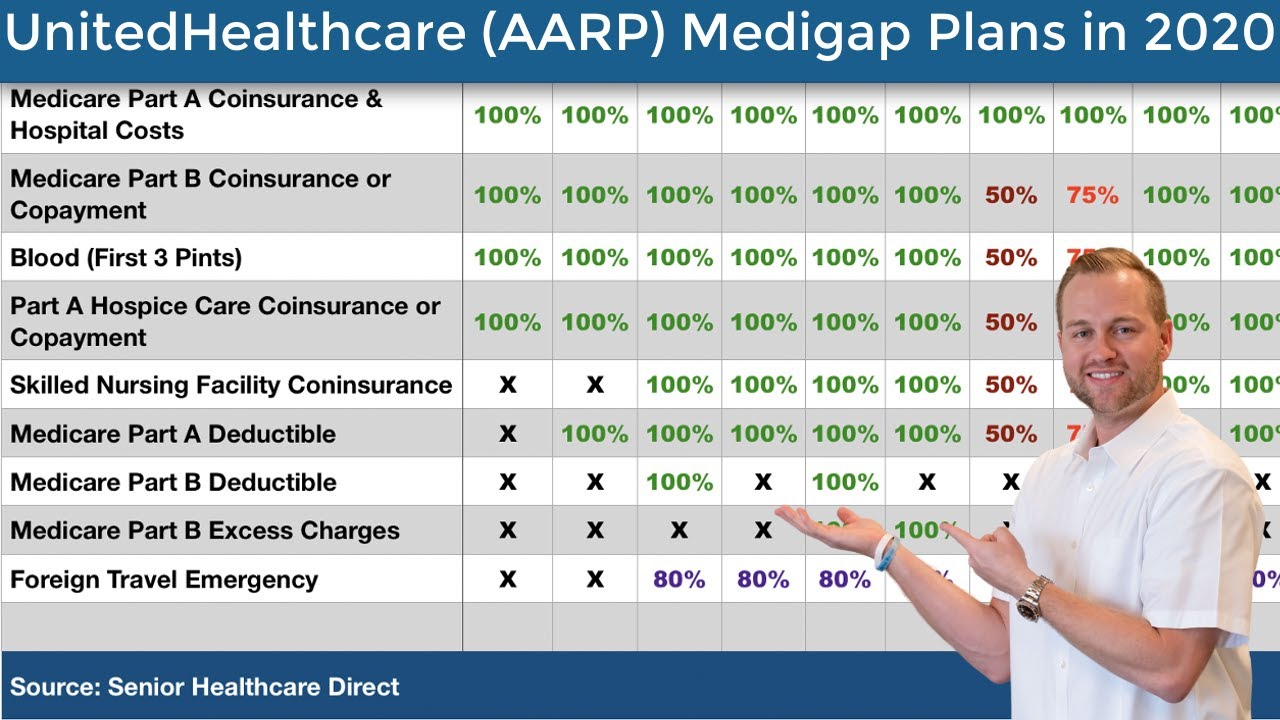

The supplemental insurance coverage provided by AARP for Medicare comes in various types, each offering unique benefits and limitations. These types include Medigap plans, Medicare Advantage plans, and Medicare Part D prescription drug plans. Understanding the differences between these plans is essential for selecting the most suitable option.

Supplemental Coverage and Benefits

Supplemental insurance offered by AARP for Medicare is designed to complement Medicare’s coverage and fill in the gaps. There are several types of supplemental insurance available, each with its own benefits and limitations.One type of supplemental insurance is Medigap. Medigap policies are standardized by the federal government, meaning that they offer a set of essential benefits regardless of the insurance company you choose.

Medigap policies are divided into 10 different plans, each with a different level of coverage. The most comprehensive Medigap plan, Plan F, covers all of the gaps in Medicare coverage, including deductibles, coinsurance, and copayments. However, Medigap policies can be expensive, and they do not cover all of the costs associated with healthcare.Another type of supplemental insurance is Medicare Advantage.

Medicare Advantage plans are offered by private insurance companies and are an alternative to traditional Medicare. Medicare Advantage plans typically offer a wider range of benefits than Medigap policies, including coverage for vision, dental, and hearing care. However, Medicare Advantage plans can also be more restrictive than Medigap policies, and they may require you to use specific providers or facilities.When choosing a supplemental insurance policy, it is important to consider your individual needs and budget.

If you have a high income, you may be able to afford a more comprehensive Medigap policy. If you have a lower income, you may want to consider a Medicare Advantage plan.Here are some examples of how supplemental insurance can help fill gaps in Medicare coverage:* Medigap policies can cover the deductibles, coinsurance, and copayments that are not covered by Medicare.

- Medicare Advantage plans can offer coverage for vision, dental, and hearing care, which are not covered by Medicare.

- Supplemental insurance can also help you pay for long-term care costs, which are not covered by Medicare.

Eligibility and Enrollment

To be eligible for AARP Medicare supplemental insurance, you must:

- Be enrolled in Medicare Part A and Part B.

- Be a U.S. citizen or permanent resident.

- Be 65 years of age or older, or under 65 and receiving Social Security Disability Insurance (SSDI) benefits.

To enroll in AARP Medicare supplemental insurance, you can:

- Call the AARP Medicare call center at 1-800-426-9232.

- Visit the AARP Medicare website at www.aarpmedicare.com.

- Contact an AARP Medicare insurance agent.

The enrollment process typically takes about 10 minutes. Once you are enrolled, your coverage will begin on the first day of the month following your enrollment date.

Age and Health Restrictions, Aarp secondary insurance to medicare

There are no age or health restrictions for AARP Medicare supplemental insurance. However, some plans may have a waiting period for certain benefits. For example, some plans may have a 6-month waiting period for coverage of prescription drugs.

Costs and Premiums

AARP Medicare supplemental insurance plans come with varying costs and premiums. Understanding these costs is crucial for making informed decisions about your coverage. Premiums for AARP Medicare supplemental insurance are influenced by several factors, including your age, health status, and the level of coverage you choose.

Premiums generally increase with age, as older individuals are more likely to utilize healthcare services. Additionally, individuals with pre-existing health conditions may face higher premiums compared to those in good health. The coverage level you select also impacts premiums, with more comprehensive plans typically costing more than basic plans.

Discounts and Subsidies

AARP Medicare supplemental insurance plans may offer discounts or subsidies to certain individuals. For example, some plans provide discounts for non-smokers or those who maintain a healthy lifestyle. Additionally, low-income individuals may qualify for subsidies to help cover the cost of premiums.

Comparison to Other Options: Aarp Secondary Insurance To Medicare

AARP Medicare supplemental insurance is not the only option available to Medicare beneficiaries. There are a variety of other supplemental insurance plans offered by private insurance companies.

When comparing AARP Medicare supplemental insurance to other options, it is important to consider the following factors:

- Coverage:AARP Medicare supplemental insurance plans offer a variety of coverage options, including coverage for deductibles, coinsurance, and copayments. Other supplemental insurance plans may offer different levels of coverage, so it is important to compare plans carefully to make sure you are getting the coverage you need.

- Premiums:AARP Medicare supplemental insurance premiums vary depending on the plan you choose and your age and health. Other supplemental insurance plans may have different premium rates, so it is important to compare plans to find the best deal.

- Network:AARP Medicare supplemental insurance plans have a large network of providers, which means you can see any doctor or hospital that accepts Medicare. Other supplemental insurance plans may have smaller networks, so it is important to make sure your preferred providers are in the network before you enroll.

- Customer service:AARP Medicare supplemental insurance plans have a reputation for good customer service. Other supplemental insurance plans may have different levels of customer service, so it is important to read reviews before you enroll.

When AARP Supplemental Insurance May Be the Best Choice

AARP Medicare supplemental insurance may be the best choice for you if you are looking for a plan that offers:

- Comprehensive coverage

- Competitive premiums

- A large network of providers

- Good customer service

AARP Medicare supplemental insurance is also a good choice for people who are already members of AARP. AARP members receive a discount on premiums, and they may also be eligible for other benefits, such as free health screenings and discounts on travel.

Final Conclusion

In conclusion, AARP secondary insurance to Medicare presents a valuable option for individuals seeking to supplement their Medicare coverage. By carefully considering eligibility requirements, costs, and customer service, individuals can make informed decisions about their healthcare coverage. Comparing AARP Medicare supplemental insurance to other options ensures that individuals select the plan that best aligns with their specific needs and preferences.

FAQ Summary

Is AARP Medicare supplemental insurance necessary?

While not mandatory, AARP Medicare supplemental insurance can provide valuable coverage for expenses not covered by Medicare, such as deductibles, copayments, and coinsurance.

What are the eligibility requirements for AARP Medicare supplemental insurance?

To be eligible for AARP Medicare supplemental insurance, individuals must be enrolled in Medicare Part A and Part B, and meet specific age and residency requirements.

How do I enroll in AARP Medicare supplemental insurance?

Enrollment in AARP Medicare supplemental insurance can be done through AARP or through an insurance agent.