Best insurance rates in nc – Navigating the insurance landscape in North Carolina can be a daunting task. However, with the right knowledge and resources, you can secure the best insurance rates that meet your specific needs. This guide delves into the intricacies of insurance coverage, factors influencing rates, and strategies for negotiating lower premiums, empowering you to make informed decisions and protect your financial well-being.

The insurance market in North Carolina offers a wide range of coverage options, from auto and home insurance to health, life, and business insurance. Understanding the nuances of each coverage type, deductibles, and premium ranges is crucial for tailoring your insurance plan to your unique circumstances.

Insurance Companies in North Carolina

North Carolina has a competitive insurance market with numerous insurance companies operating within the state. These companies vary in size, market share, financial stability, and customer satisfaction ratings. Some of the most prominent insurance companies in North Carolina include:

Market Share and Financial Stability

- State Farm: State Farm is the largest insurance company in North Carolina, with a market share of over 20%. It is also one of the most financially stable insurance companies in the country, with an A++ rating from A.M. Best.

- Allstate: Allstate is the second-largest insurance company in North Carolina, with a market share of around 15%. It is also financially stable, with an A+ rating from A.M. Best.

- Progressive: Progressive is the third-largest insurance company in North Carolina, with a market share of around 10%. It is known for its competitive rates and its focus on online insurance sales.

Customer Satisfaction Ratings

- USAA: USAA is a military-focused insurance company that consistently receives high customer satisfaction ratings. It is known for its excellent customer service and its competitive rates.

- Geico: Geico is another insurance company that consistently receives high customer satisfaction ratings. It is known for its low rates and its easy-to-use website.

- Amica Mutual: Amica Mutual is a mutual insurance company that is known for its high customer satisfaction ratings and its financial stability.

Unique Offerings and Specializations

- North Carolina Farm Bureau: The North Carolina Farm Bureau is a specialized insurance company that provides insurance coverage to farmers and ranchers. It is the largest farm insurer in North Carolina.

- Piedmont Natural Gas: Piedmont Natural Gas is a utility company that also offers insurance coverage to its customers. It is the largest provider of natural gas in North Carolina.

- Truist: Truist is a bank that also offers insurance coverage to its customers. It is one of the largest banks in North Carolina.

Types of Insurance Coverage Available

In North Carolina, a range of insurance coverage options are available to protect individuals, families, and businesses from financial risks. These include auto, home, health, life, and business insurance, each offering specific coverage options, deductibles, and premium ranges.

Factors such as the level of coverage desired, the value of the assets being insured, and the individual’s or business’s risk profile influence insurance rates for different coverage types.

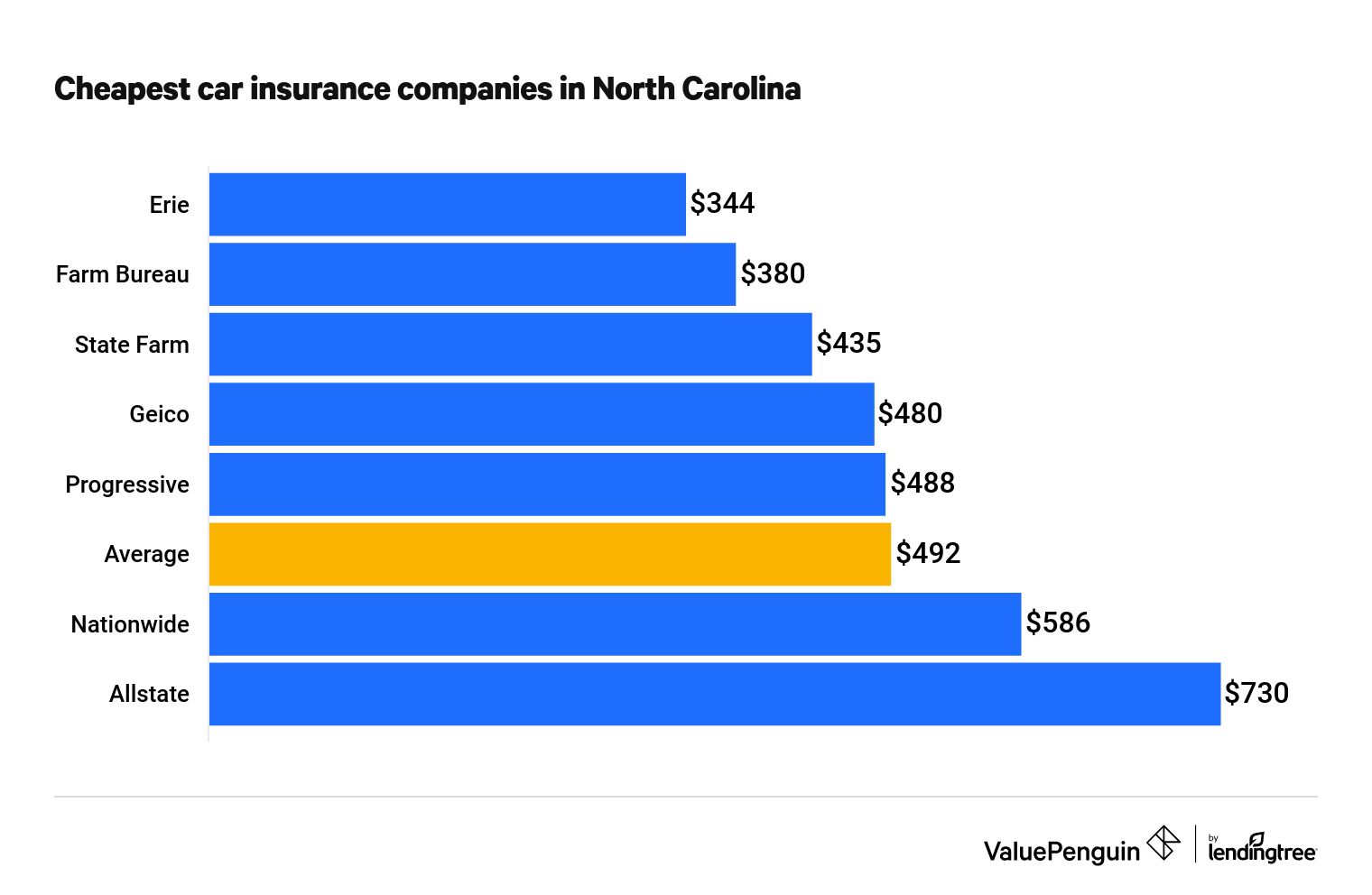

Auto Insurance

- Liability coverage: Protects against financial responsibility for injuries or property damage caused to others in an accident.

- Collision coverage: Covers damage to the insured’s own vehicle in an accident.

- Comprehensive coverage: Protects against damage from non-collision events, such as theft, vandalism, or weather-related incidents.

Deductibles for auto insurance typically range from $250 to $1,000, with higher deductibles resulting in lower premiums.

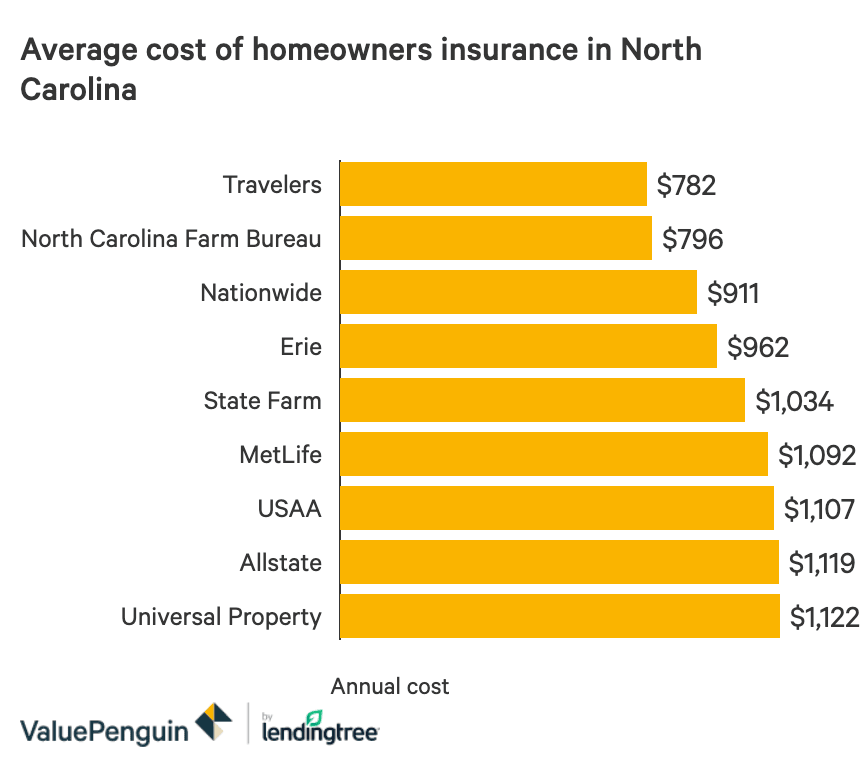

Home Insurance

- Dwelling coverage: Protects the physical structure of the home.

- Personal property coverage: Covers the belongings inside the home.

- Liability coverage: Protects against financial responsibility for injuries or property damage caused to others on the property.

Deductibles for home insurance typically range from $500 to $2,500, with higher deductibles resulting in lower premiums.

Health Insurance

- Major medical insurance: Covers a wide range of medical expenses, including hospital stays, doctor visits, and prescription drugs.

- Supplemental health insurance: Provides additional coverage for specific expenses, such as dental, vision, or long-term care.

Health insurance premiums vary depending on the level of coverage, the deductible, and the individual’s or family’s health history.

Life Insurance

- Term life insurance: Provides a death benefit for a specified period.

- Whole life insurance: Provides a death benefit and accumulates a cash value that can be borrowed against.

Life insurance premiums are based on the individual’s age, health, and the amount of coverage desired.

Business Insurance

- Property insurance: Protects against damage to the business’s property, including buildings, equipment, and inventory.

- Liability insurance: Protects against financial responsibility for injuries or property damage caused to others by the business.

- Business interruption insurance: Covers lost income and expenses if the business is unable to operate due to a covered event.

Business insurance premiums vary depending on the type of business, the size of the business, and the level of coverage desired.

Factors Affecting Insurance Rates: Best Insurance Rates In Nc

Determining insurance rates in North Carolina involves careful consideration of various factors that influence the level of risk associated with each individual or property. These factors play a crucial role in calculating insurance premiums, ensuring that the rates are commensurate with the potential costs of coverage.

Several key factors significantly impact insurance rates in North Carolina. Understanding how these factors contribute to premium calculations can help individuals make informed decisions about their insurance coverage.

Age

Age is a primary factor that affects insurance rates, particularly for auto insurance. Younger drivers, typically those under the age of 25, are statistically more likely to be involved in accidents. This increased risk leads to higher insurance premiums for younger drivers compared to older, more experienced drivers.

Driving History

Driving history is another significant factor that influences auto insurance rates. Drivers with a clean driving record, free of accidents and traffic violations, are generally eligible for lower premiums. Conversely, drivers with a history of accidents or traffic violations face higher premiums due to the increased risk they pose to insurance companies.

Location

The location where a vehicle is registered and primarily driven can impact insurance rates. Areas with higher rates of accidents, traffic congestion, and crime tend to have higher insurance premiums. Insurance companies assess the risk associated with the specific location and adjust premiums accordingly.

Property Value, Best insurance rates in nc

For homeowners insurance, the value of the property plays a crucial role in determining insurance rates. Higher-value properties generally require higher insurance coverage limits, which in turn leads to higher premiums. Factors such as the size, age, and construction materials of the property also influence insurance rates.

Health Status

Health status is a primary factor that affects health insurance rates. Individuals with pre-existing medical conditions or a history of health issues may face higher premiums. Insurance companies assess the potential risk of future medical expenses based on an individual’s health status and adjust premiums accordingly.

In addition to these key factors, insurance companies may also consider other variables when calculating insurance rates. These may include factors such as the type of insurance coverage, deductibles, and policy limits. Understanding the factors that affect insurance rates empowers individuals to make informed decisions about their insurance coverage and potentially qualify for discounts or incentives that can lower their premiums.

Comparing Insurance Quotes

Obtaining the best insurance rates in North Carolina necessitates comparing quotes from multiple insurance providers. By comparing quotes, you can identify the insurer that offers the most competitive rates and coverage that meets your specific needs.

To gather insurance quotes effectively, follow these steps:

- Determine Your Coverage Needs:Identify the types of insurance coverage you require, such as auto, home, or health insurance.

- Collect Information:Gather essential information, including your personal details, driving history (for auto insurance), property details (for home insurance), and health history (for health insurance).

- Request Quotes:Contact several insurance companies directly or through an insurance broker to request quotes based on your coverage needs and personal information.

Advantages and Disadvantages of Using Insurance Brokers and Online Comparison Tools

Insurance BrokersAdvantages:

- Provide personalized advice and guidance.

- Access to a wider range of insurance companies.

- Can negotiate lower rates on your behalf.

Disadvantages:

- May charge a fee for their services.

- Can be influenced by their relationships with specific insurance companies.

Online Comparison ToolsAdvantages:

- Convenient and easy to use.

- Provide quick access to quotes from multiple insurance companies.

- Can be used to compare rates and coverage options.

Disadvantages:

- May not offer personalized advice or guidance.

- Limited to the insurance companies included in the tool.

- Can be biased towards certain insurance companies.

Additional Considerations

Securing the most favorable insurance rates often extends beyond comparing quotes. This section delves into additional strategies and insights to optimize your insurance coverage while minimizing costs.

Negotiation Tips

Negotiating with insurance providers can yield substantial savings. Consider the following tactics:

- Bundling Policies:Combining multiple insurance policies (e.g., home and auto) with the same insurer often qualifies for discounts.

- Increasing Deductibles:Raising your deductible (the amount you pay out-of-pocket before insurance coverage kicks in) typically lowers your premiums.

- Maintaining Good Credit:Many insurance companies consider credit scores when determining rates, as higher scores indicate lower risk.

Insurance Regulators

Insurance regulators play a crucial role in ensuring fairness and competition within the insurance industry. These agencies:

- Set and enforce regulations to protect consumers.

- Review and approve insurance rates to ensure they are reasonable and non-discriminatory.

- Investigate complaints and resolve disputes between insurers and policyholders.

Emerging Trends and Innovations

The insurance industry is constantly evolving, with new technologies and trends shaping the future of insurance rates:

- Telematics:Devices installed in vehicles track driving habits, potentially leading to lower rates for safe drivers.

- Artificial Intelligence (AI):AI algorithms are used to analyze data and identify patterns, allowing insurers to more accurately assess risk and set rates.

- InsurTech:Startups are disrupting the insurance market with innovative products and services, such as on-demand insurance and peer-to-peer insurance.

Ending Remarks

In conclusion, securing the best insurance rates in North Carolina requires a comprehensive approach that considers multiple factors, compares quotes diligently, and explores negotiation strategies. By following the insights Artikeld in this guide, you can navigate the insurance landscape with confidence, ensuring that you are adequately protected without overpaying for coverage.

Key Questions Answered

What factors influence insurance rates in North Carolina?

Factors affecting insurance rates include age, driving history, location, property value, and health status.

How can I compare insurance quotes effectively?

Gather quotes from multiple insurance companies, compare coverage options, deductibles, and premiums, and consider using insurance brokers or online comparison tools.

What strategies can I use to negotiate lower insurance rates?

Consider bundling policies, increasing deductibles, maintaining a good credit score, and exploring discounts and incentives for improving risk factors.