Discover the world of Humana Medicare Supplement insurance plans, tailored to empower you with a deeper understanding of your healthcare coverage options. Our comprehensive guide unveils the benefits, types, costs, eligibility criteria, and decision-making factors to help you make informed choices that safeguard your health and well-being.

Humana’s Medicare Supplement insurance plans offer a wide range of coverage options, providing peace of mind and financial protection against unexpected medical expenses. By exploring the details of these plans, you can make confident decisions that align with your healthcare needs and budget.

Introduction

This article aims to provide an overview of Humana Medicare Supplement insurance plans, specifically designed for individuals seeking supplemental coverage to enhance their original Medicare benefits. Understanding these plans can empower you to make informed decisions regarding your healthcare coverage options.Medicare Supplement insurance plans, often referred to as Medigap policies, are designed to cover out-of-pocket costs associated with original Medicare, such as deductibles, copayments, and coinsurance.

By choosing the right Medigap plan, you can minimize the financial burden of healthcare expenses and enjoy greater peace of mind.

Benefits of Humana Medicare Supplement Insurance Plans

Humana Medicare Supplement insurance plans offer a range of benefits that can help you cover the costs of healthcare not covered by Original Medicare. These plans are designed to provide you with peace of mind and financial protection, ensuring that you have access to the healthcare services you need.Humana’s Medicare Supplement plans are highly competitive in the market, offering a wide range of benefits and features.

Compared to other Medicare Supplement insurance plans, Humana’s plans often include:

Lower Out-of-Pocket Costs

Humana’s Medicare Supplement plans can help you reduce your out-of-pocket costs for healthcare. These plans cover a variety of expenses that Original Medicare does not, such as:

- Copayments for doctor visits and hospital stays

- Deductibles for Part A and Part B

- Coinsurance for Part A and Part B

- Excess charges

- Foreign travel emergency care

Comprehensive Coverage

Humana’s Medicare Supplement plans offer comprehensive coverage that goes beyond Original Medicare. These plans cover a wide range of healthcare services, including:

- Hospitalization

- Skilled nursing facility care

- Home health care

- Durable medical equipment

- Preventive care

- Prescription drug coverage (in some plans)

Flexible Plan Options

Humana offers a variety of Medicare Supplement plan options to meet your individual needs and budget. These plans range from basic coverage to more comprehensive coverage, allowing you to choose the plan that best fits your healthcare needs and financial situation.

Nationwide Acceptance

Humana’s Medicare Supplement plans are accepted by healthcare providers nationwide. This means that you can access the healthcare services you need, regardless of where you live or travel.

Peace of Mind

Humana’s Medicare Supplement plans can provide you with peace of mind knowing that you have coverage for the costs of healthcare not covered by Original Medicare. These plans can help you protect your finances and ensure that you have access to the healthcare services you need, when you need them.

Types of Humana Medicare Supplement Insurance Plans

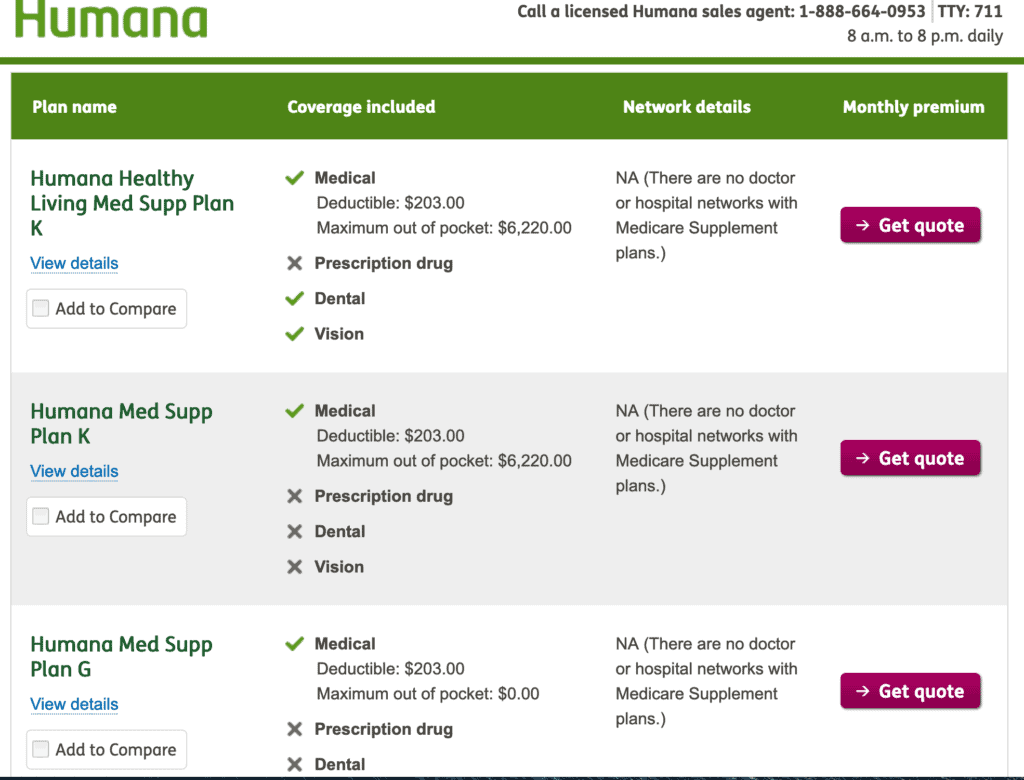

Humana offers a range of Medicare Supplement insurance plans designed to provide additional coverage beyond Original Medicare. Each plan offers varying levels of coverage and benefits, allowing you to choose the one that best meets your specific needs and budget.

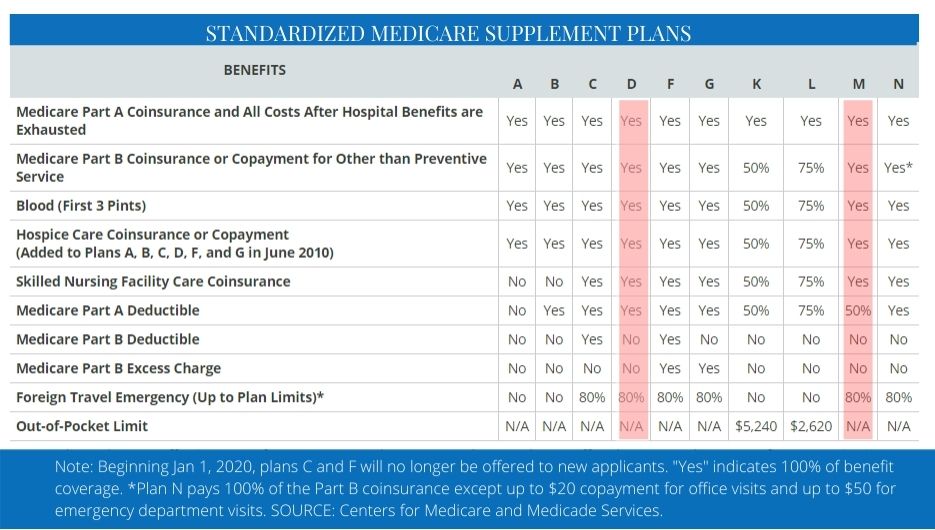

Humana’s Medicare Supplement plans are categorized into Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, and Plan N. Each plan provides different levels of coverage, with Plan A offering the most basic coverage and Plan F offering the most comprehensive coverage.

Plan A

- Covers hospital coinsurance and daily copayments

- Does not cover Part B deductible, skilled nursing facility coinsurance, or hospice care

Plan B

- Covers everything Plan A covers, plus

- Part B deductible

- Foreign travel emergency care

Plan C

- Covers everything Plan B covers, plus

- Part A deductible

- Blood transfusions

Plan D

- Covers everything Plan C covers, plus

- Skilled nursing facility coinsurance

- Foreign travel emergency care

Plan F, Humana medicare supplement insurance plans

- Covers everything Plan D covers, plus

- Part B excess charges

- Coinsurance for hospice care

Plan G

- Covers everything Plan F covers, except

- Part B excess charges

Plan N

- Covers everything Plan G covers, except

- Part B deductible

- Coinsurance for hospice care

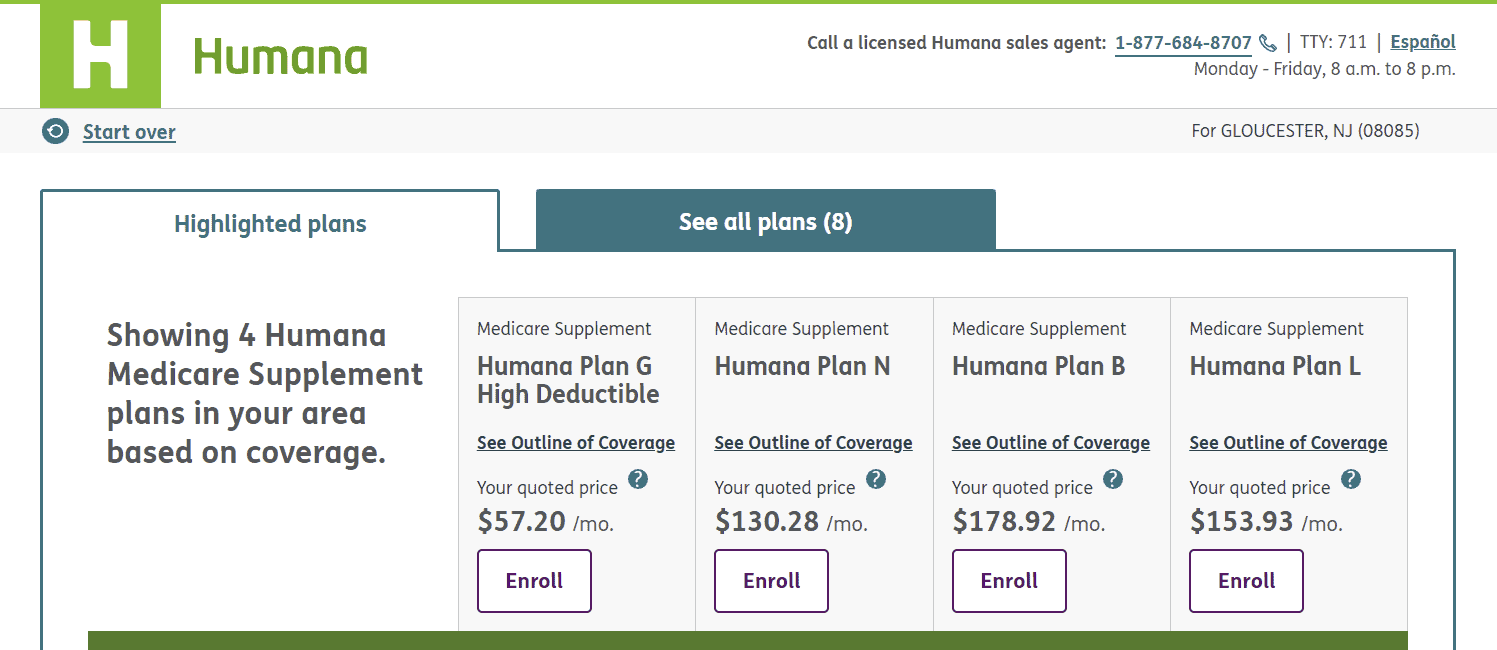

Costs of Humana Medicare Supplement Insurance Plans

Humana Medicare Supplement insurance plans, also known as Medigap plans, are designed to cover the out-of-pocket costs associated with Original Medicare, such as deductibles, copayments, and coinsurance. The cost of these plans varies depending on several factors, including the type of plan, the age and health of the applicant, and the location where the plan is purchased.

There are 10 standardized Medigap plans available, each with a different set of benefits and costs. The most comprehensive plan, Plan F, covers all of the out-of-pocket costs associated with Original Medicare, while the least comprehensive plan, Plan A, covers only the Part A deductible.

The cost of each plan varies depending on the age and health of the applicant, as well as the location where the plan is purchased.

Factors that Affect the Cost of Humana Medicare Supplement Insurance Plans

- Age:The cost of a Humana Medicare Supplement insurance plan increases with age. This is because older adults are more likely to use healthcare services, which drives up the cost of coverage.

- Health:The cost of a Humana Medicare Supplement insurance plan can also be affected by the applicant’s health. People with pre-existing conditions or chronic illnesses may be charged higher premiums than those who are healthy.

- Location:The cost of a Humana Medicare Supplement insurance plan can also vary depending on the location where the plan is purchased. This is because the cost of healthcare varies from state to state.

How to Choose the Right Humana Medicare Supplement Insurance Plan

Choosing the right Humana Medicare Supplement insurance plan can be a daunting task. With so many different plans available, it can be difficult to know which one is right for you. However, by following a few simple tips, you can make the process much easier.

Factors to Consider

When choosing a Humana Medicare Supplement insurance plan, there are a few key factors to consider:

- Your budget:Medicare Supplement insurance plans can vary significantly in price, so it’s important to choose a plan that fits your budget.

- Your health needs:If you have any specific health needs, you’ll want to choose a plan that covers those needs.

- Your lifestyle:If you travel frequently, you’ll want to choose a plan that covers you outside of the United States.

Tips for Choosing a Plan

Once you’ve considered the factors above, you can start shopping for a Humana Medicare Supplement insurance plan. Here are a few tips to help you choose the right plan:

- Get quotes from multiple insurance companies.This will help you compare prices and coverage options.

- Read the policy carefully before you buy it.Make sure you understand what the plan covers and what it doesn’t cover.

- Talk to your doctor or a financial advisor.They can help you assess your needs and choose the right plan for you.

Conclusion

Choosing the right Humana Medicare Supplement insurance plan can help you protect your health and your finances. By following these tips, you can find a plan that meets your needs and budget.

Conclusion

Humana Medicare Supplement insurance plans can provide comprehensive coverage for out-of-pocket medical expenses. By understanding the different types of plans available, their costs, and how to choose the right plan for your needs, you can make an informed decision that will help you protect your health and finances.

To learn more about Humana Medicare Supplement insurance plans and find the right plan for you, contact a licensed insurance agent or visit the Humana website.

Summary

Navigating the complexities of Medicare Supplement insurance can be a daunting task, but with Humana’s plans, you can rest assured that your health coverage is in good hands. Our guide has equipped you with the knowledge and insights necessary to make informed decisions about your healthcare future.

By choosing the right Humana Medicare Supplement insurance plan, you can safeguard your health and financial security, ensuring a brighter and healthier tomorrow.

Top FAQs: Humana Medicare Supplement Insurance Plans

What is the purpose of Humana Medicare Supplement insurance plans?

Humana Medicare Supplement insurance plans are designed to fill the gaps in Original Medicare coverage, providing additional protection against out-of-pocket healthcare expenses.

How do Humana Medicare Supplement plans compare to other Medicare Supplement plans?

Humana’s Medicare Supplement plans offer competitive coverage and benefits, including a range of plan options to meet diverse needs and budgets.

What factors affect the cost of Humana Medicare Supplement plans?

The cost of Humana Medicare Supplement plans can vary based on factors such as age, health status, and the specific plan selected.

Who is eligible for Humana Medicare Supplement plans?

To be eligible for Humana Medicare Supplement plans, you must be enrolled in Original Medicare Part A and Part B and meet certain other eligibility requirements.

How do I choose the right Humana Medicare Supplement plan?

Consider your healthcare needs, budget, and preferences when selecting a Humana Medicare Supplement plan. Consult with a licensed insurance agent for personalized guidance.